Fossil fuel companies are structurally incapable of transitioning to become clean energy companies of their own accord.

The revolving door between commercial banks and fossil fuel companies keeps on spinning.

Tushar Morzaria, finance director at Barclays’ Group, has joined BP as a non-executive director. He’s the latest addition to BP’s revamped leadership, alongside new CEO Bernard Looney and CFO Murray Auchincloss.

At the beginning of 2020, Brian Gilvary moved in the opposite direction. He had worked for BP for 30 years and was CFO for eight. He joined Barclays as a non-executive director, celebrated on arrival by the bank for bringing experience “and understanding of the challenges and opportunities inherent in the energy transition, including the acceleration of key renewable options and developing key capital intensive clean energy technologies”.

Greenwash

It’s indicative of Barclays’ trajectory on fossil fuel financing that the bank should look to a veteran of BP for climate leadership. Gilvary and BP’s expertise is in exaggerating green credentials as cover for continued profiting from fossil fuel extraction. Expect a similar strategy from Barclays.

Since Bernard Looney began as BP’s CEO early in 2020, BP’s rebrand as modern, responsible and climate-conscious has gone into overdrive. He would be undoubtedly eager to reject claims that the revolving door between banks and fossil fuel companies is toxic.

What could be more beautiful than a deep-rooted culture of synergy between two corporate sectors mutually committed to climate action? The problem: neither one of them is.

Looney’s first landmark intervention in February 2020 was committing BP to an ambition of net-zero emissions by 2050. This included cutting the carbon intensity (as opposed to absolute emissions) of energy by only 50 percent, and Looney confirmed BP would still be producing oil and gas in 2050. This was a headline grabbing target, charting a course to climate chaos.

Fossil fuel companies are structurally incapable of transitioning to become clean energy companies of their own accord.

In August 2020, BP announced plans to cut fossil fuel production by 40 percent by 2030. Another headline grabbing announcement, but insufficient in scale and ambition.

Financing

Looney’s modernising efforts are limited to dressing casually “wearing an open-necked shirt with jeans and using Instagram” while making inadequate promises on fossil fuel production that he cannot keep.

Fossil fuel companies are structurally incapable of transitioning to become clean energy companies of their own accord.

To make their profits, they must continually discover and extract fossil fuels to sell long after 2050. The revolving door between banks and fossil fuel companies contributes to embedding into the financial sector this culture of support for long-term fossil fuel extraction.

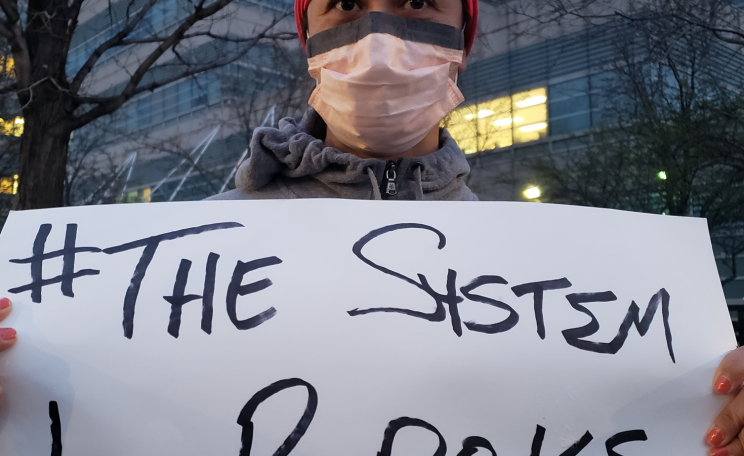

The exchange of personnel between Barclays and BP comes as the bank is pressured by campaigners to drop its support for fossil fuels. People & Planet students have disrupted Barclays’ AGMs, protesting the bank’s fossil fuel financing.

In 2019, Momentum joined People & Planet in targeting Barclays with protests around the country. In 2018, Greenpeace scaled Barclays’ Canary Wharf HQ in a major protest, and in 2020 shut down over 100 Barclays branches. Fund our Future campaigners targeted Barclays’ Piccadilly Circus branch over the bank’s support for coal. Barclays is also an ongoing target for Extinction Rebellion.

Targets

Barclays is the worst bank in Europe for financing fossil fuels, having provided almost £91 billion between the end of 2015 (when the Paris Agreement was signed) and 2019.

In 2019, Barclays updated its coal policy to exclude finance for new coal projects, but it wasn’t financing them anyway and continues financing the companies behind coal. ShareAction also called the bank “a global player” in tar sands, one of the most dangerous fossil fuels.

Like BP, Barclays has its own commitment for net-zero by 2050. Also like BP, its target is meaningless based on current activities. For banks and fossil fuel companies, the profits of fossil fuel extraction remain too alluring to contribute to a meaningful transition.

As long as financiers fill the boardrooms of fossil fuel companies, and oil barons are rewarded with prestigious positions in our financial system, climate ambitions set by both industries will remain a mere pipe dream.

Pervasive

The revolving door is hardly limited to Barclays and BP executives. Bloomberg research has shown that this culture spans the biggest banks and energy companies.

JPMorgan Chase is the worst bank in the world for financing fossil fuels - no surprise given the influence of Lee Raymond, former CEO and Chairman of ExxonMobil, who has been an independent director at the bank since 2013 and key adviser to CEO Jamie Dimon.

A director at Citi (third worst fossil bank) is Ernesto Zedillo, former President of Mexico and Member of BP’s International Advisory Board. Bank of America (fourth worst fossil bank) includes Denise Ramos as a director, a position she also holds at Texas oil and gas company Phillips 66.

Of UK banks, HSBC’s independent non-executive director Pauline van der Meer Mohr held various executive positions at Shell over 15 years. Standard Chartered’s independent non-executive director Dr Byron Grote worked at BP for 25 years, including as a managing director, CFO, and executive vice-president.

Future

It’s clear that fossil fuel companies need banks. Their financing is crucial to expanding extraction in the coming decades.

It’s less clear that banks need fossil fuel companies. They are a source of short-term profit, but banks could exist successfully without the fossil fuel industry. Especially as it poses an existential threat to life on our planet. But still, the revolving door between the two spins as reliably as ever.

How can banks take responsible decisions on climate and energy transition when fossil fuel executives occupy director roles across the sector?

If banks like Barclays are serious about playing their role in climate transition, they must phase out financing for all fossil fuel companies and projects. This includes immediately stopping funding for coal and ending mutual-pat-on-the-back relationships in the boardroom.

Any net-zero targets must be backed up with credible immediate and long-term transition plans. Banks must prohibit financing for any project or company which abuses human rights, including Indigenous rights.

But none of this is possible until we stamp out the myriad conflicts of interest plaguing fossil fuel companies and their financiers.

This Author

J Clarke is co-director of campaigns at People & Planet, part of the FundOurFuture.uk network.